Last year was not an easy year for many. We had terrorism attacks in Paris, France and Istanbul, Turkey, Nigeria, Kenya, Australia and elsewhere; we experienced the global economy struggling, ISIS reach formidable and so many more. 2016 is surely a fresh beginning.

A friend from China was to have visited me on 1 January 2016 - but he had planned to be here earlier for Christmas. His intention was to celebrate both Christmas and New Year. After the terrorist attacks in Paris in November he changed his mind. He cancelled those flights as he was concerned it might be not safe to do so.

When I collected him at the Sydney International Airport days after New Year, he asked about the New Year Sydney Harbour fireworks. When I said it was perfect, he sighed, he missed out due to fear. He chose to play safe. I could feel his regret.

He had also visited me in April last year. He had invested a lot of his money into the Chinese Share Market and gained a considerable amount in May. He then sold his stocks before the Share Market Crises in June. Why such share market success? His reasoning was a lack of greed. Although the index of the Share Market was still going up, he pulled his money out at the right time. He avoided a huge loss.

However, he went back in and this time was not so fortunate. It's tricky. He explained the best time to avoid share market loss was the last few days of December, but wasn't quick enough. We were talking about why he made this loss in the Share Market this time round. He told me he was too greedy to earn more. He was thinking to sell all his stocks in late of December, but he wanted to try his luck by holding those stocks longer.

This was his explanation - when the Federal Reserve of America announced increasing the interest on the US dollar, it was expected capital around the world would have invested in the US. However, due to the weak real economy, the global capital had no choice but to invest in US Share Market. Currently the index of US Share Market is at a high position; share price couldn't reflect the real value of certain stock.

Once capital left one country returning to the US, if the country doesn't have enough US dollar reserve it's local currency could face high risk of decreased value. So such countries tried their best to stop capital leaving.

In the meantime, US dollar is currently the only currency for Oil Purchases in OPEC; oil is the most important resource for a country to develop, so those countries needed to have 'reserves' in US dollars.

Moreover, the chaos in Middle East right now will bring a lot of uncertainty in the near future.

Year 2016 might be another tough year whether you are living in China, Kenya, England, Germany, anywhere really ....

I have committed myself to pray for the leaders of major economic counties - they might make positive decisions to retain sensibilities in the world economy and moreover, the difficulties associated with 'peace in our time'.

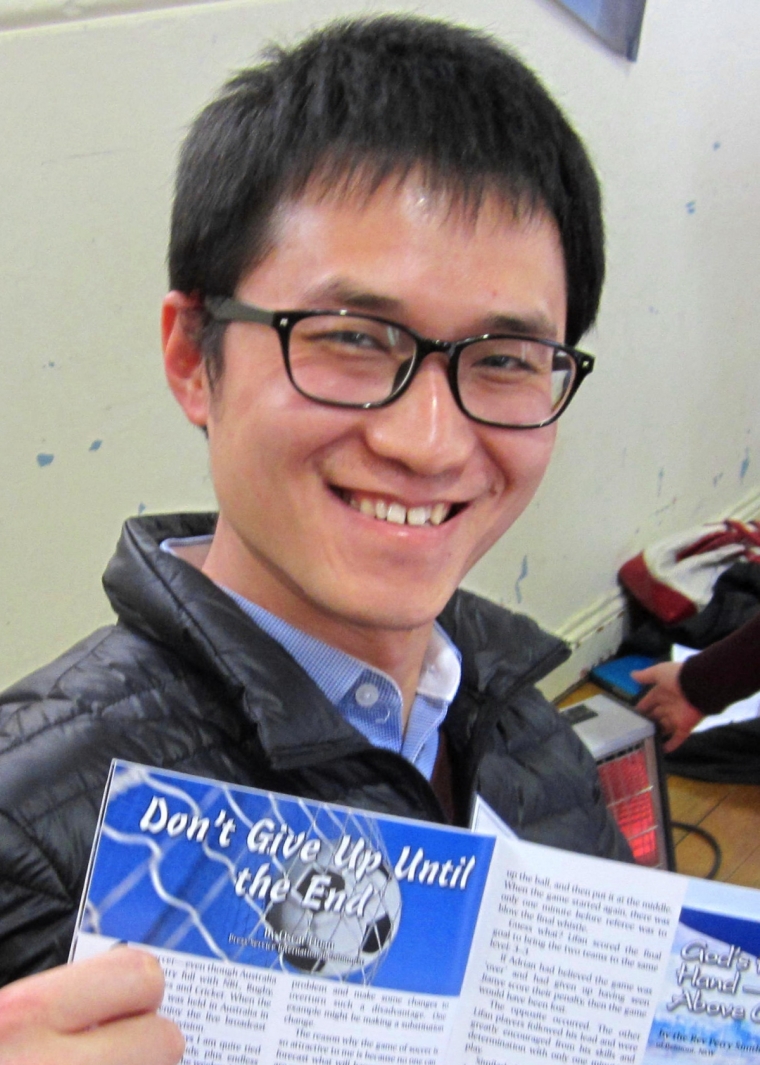

Oscar Duan is from China, he has an accountancy degree from University of Hertfordshire (UH) International campus in Malaysia, and has undertaken further accountancy studies in Australia for accreditation here. He is married to Heyley.

Oscar Duan's previous articles may be viewed at www.pressserviceinternational.org/oscar-duan.html